CDX My New Favorite "Safe" Investment

My sister and I have very different investment styles. She's a successful dentist and executive, married to a doctor, with a low risk tolerance. While her income is a lot more stable and predictable than mine, I tend to have bigger "wins" in both my career and in my investments.

I was surprised when I turned up something that seemed like a great blend of both our styles.

Before we get started--since I'm discussing a specific ETF:

- This is not financial advice

- And nothing is safe--I just like the risk profile

- Before you take a position, figure out for yourself if this is a fit for you

What I Was Looking For

As I discussed before, my wife and I are "turtling up" to ride out a downturn in the tech industry that looks like it's going to last longer (and maybe get deeper) than anyone would like. For us, that means sell our residential real-estate investments.

I've been looking for a position that was "safe" enough to allow me to put most of my net worth into it. The default answer was going to be 2-year to 3-year treasury bonds, which currently yields 4.8%.

Those have a very solid, if boring return profit:

- Earn 4.8% / year

- If bond yields fell (bond prices rose) over the course of the next year, then I might make another 5% or during that time

- If bond yields rise (bond price fell), then I could just wait out the duration of the bond with no risk to my capital

Overall, not a bad bet, given my market outlook. I could take whatever I had by the end of this next run, move it over, and ride out the downturn I see coming.

But of course, being me, I've been looking for something with a little more juice.

A High-Yield ETF with a Credit Hedge

I came across Simplify Asset Management's CDX ETF, and I really like what I see. It's a bit of complex product, so before I dig into the details, here's the general idea:

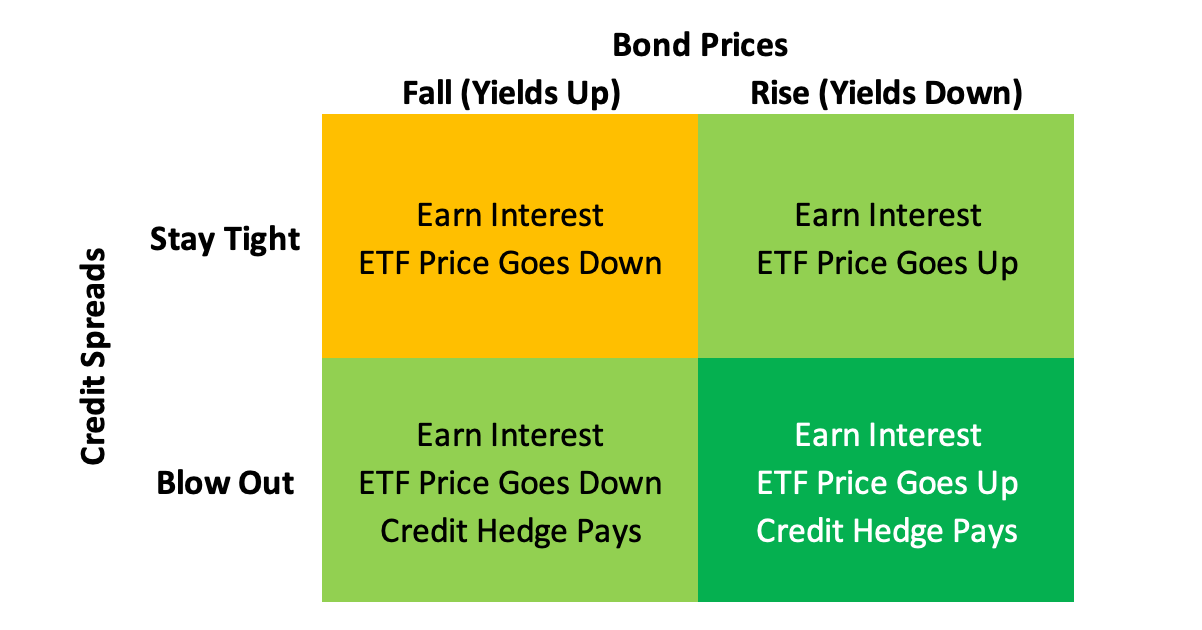

- Invest in high yield corporate bonds, resulting in a higher interest rate than available from investment-grade corporate bonds or treasury bonds

- Some of the interest is used to fund a hedge that pays if credit spreads blow out (which should happen if we hit a recession)

What are Credit Spreads?

To understand the opportunity, we need to know what a "credit spread" is.

In general, different bond issuers have to pay different interest rates based on how likely they are considered to default:

- Treasury Bonds are bonds issued by the US government and considered to be 100% "safe" in that the US government will always be able to pay (though rates may change and bonds may lose value)

- Investment Grade Bonds are bonds issued by companies that have very strong businesses and balance sheets. Think Apple, which is quite profitable and had $73B of cash on hand as of December 2023

- High Yield Bonds (or Junk Bonds) are issued by companies aren't so strong and have a meaningful chance to default

The "credit spread" is the additional interest a high yield rated company has to pay vs what an investment grade company would pay. When the economy is good, the spreads are tight. When the economy is in trouble, spreads tend to blow out (widen) as investors become more concerned about the ability for lower-rated companies to pay back their debts.

By combining high yield bonds with a hedge against credit spreads widening, you earn higher interest rate (~8%) combined with a position that (hopefully) pays out if the economy falls apart.

CDX Holdings

As of 5/13/24, this is what the ETF held (it can change at any time):

- Core high yield corporate bond position (100%)

- T-Bill Ladder (100%)

- Short Cash (-100%) – I assume this nets to 0% because holding t-bills = cash

- Hedges

- Long an SPX put spread

- Long equity in "quality" companies (+30%)

- Short equity in "junk" companies (-25%)

- Also, in a recent podcast, Michael Green said that $CDX was looking to add derivative exposure to directly hedge high yield credit spreads to provide more convexity to the return profile

Summary

I think this is a great position to take. You get paid--something, not sure how much--if there's a recession. That's a hedge against all the risks I see building up in the market, but hedges usually cost money. Instead, CDX pays 8% / year while you wait to find out if the bad actually comes.

Here are the possible outcomes:

The only way I see this losing money is if--somehow--bond yields rise (bond prices fall) while credit spreads don't widen. While anything is possible, that seems particularly unlikely. The only way I can imagine that is if the government stepped in to guarantee these bonds while simultaneously allowing Treasury bond yields to rise--and that seems very unlikely.