Market Outlook - May 2024

Alright, time for something a bit less philosophical. Here's my outlook for the rest of 2024. Should you care, even if you don't trade or invest? Yes!

We live in crazy times where things like market performance and monetary liquidity determine the course of everything in lives: our jobs, our house prices, and even political events. So...even if you're not directly trying to profit from these moves, they matter.

Through the Summer / Election

The Biden administration is incentivized to make everything look as good as possible between now and election day--so I think things will look as good as possible! Easy peasy.

More specifically, though:

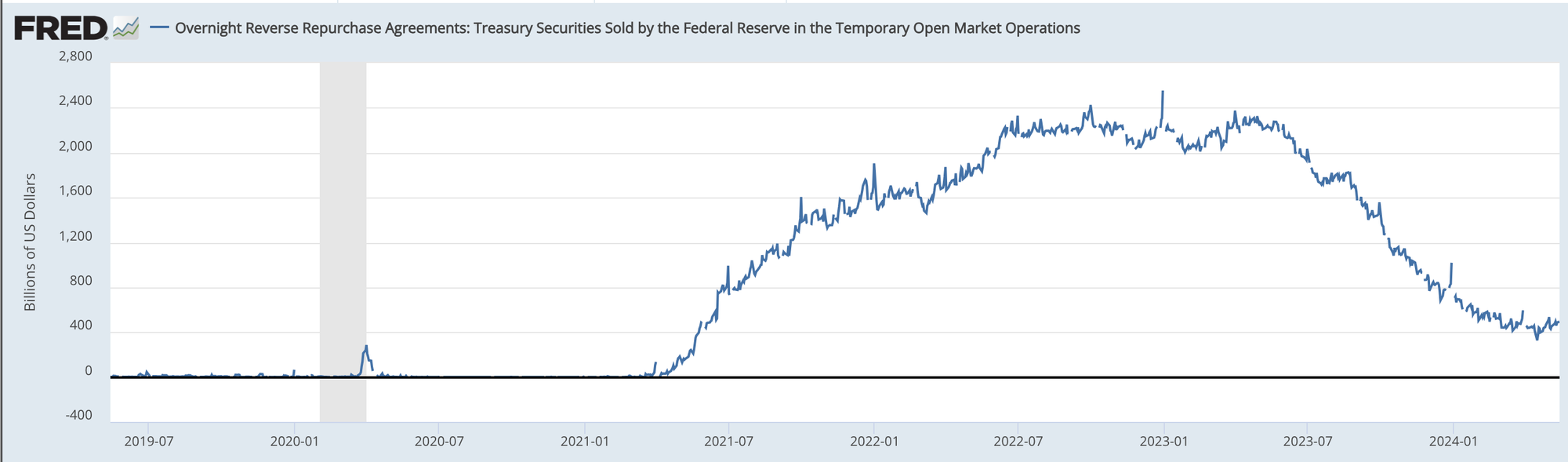

There's still nearly $500B in the Reverse Repo Facility (money that can be pulled out to provide financial liquidity):

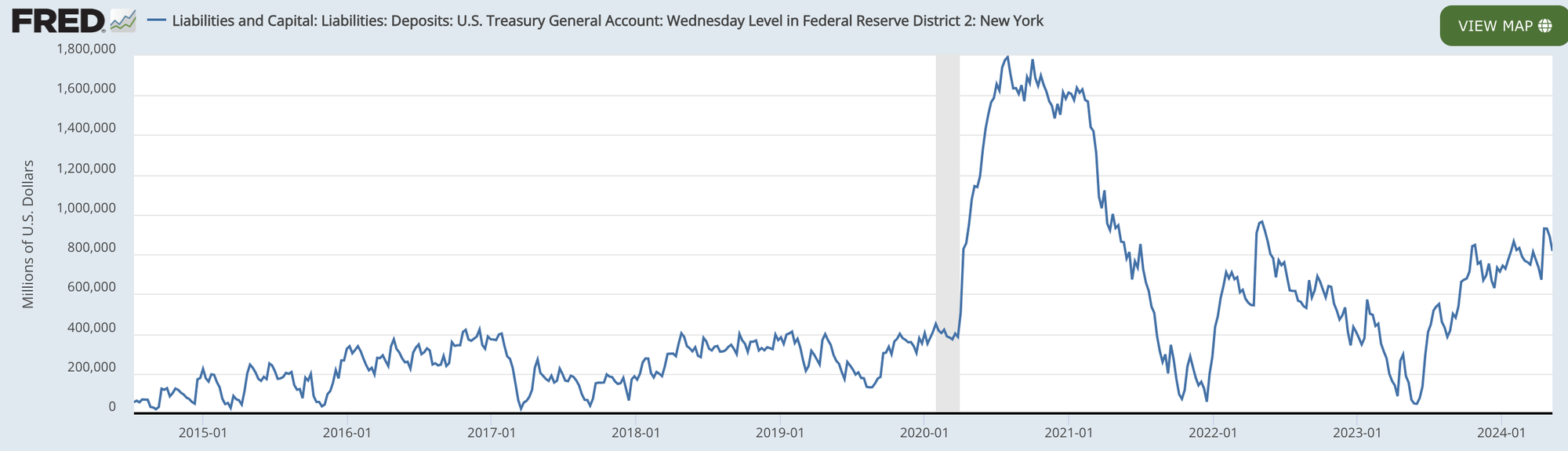

As of 5/8, the Treasury General Account (the Federal government's checking account) had over $800B in it:

And finally, the Biden administration has put forward a plan to re-instate a federally-backed 2nd mortgages, which would allow homeowners to access up to $4 Trillion in home equity to pay on-going expenses.

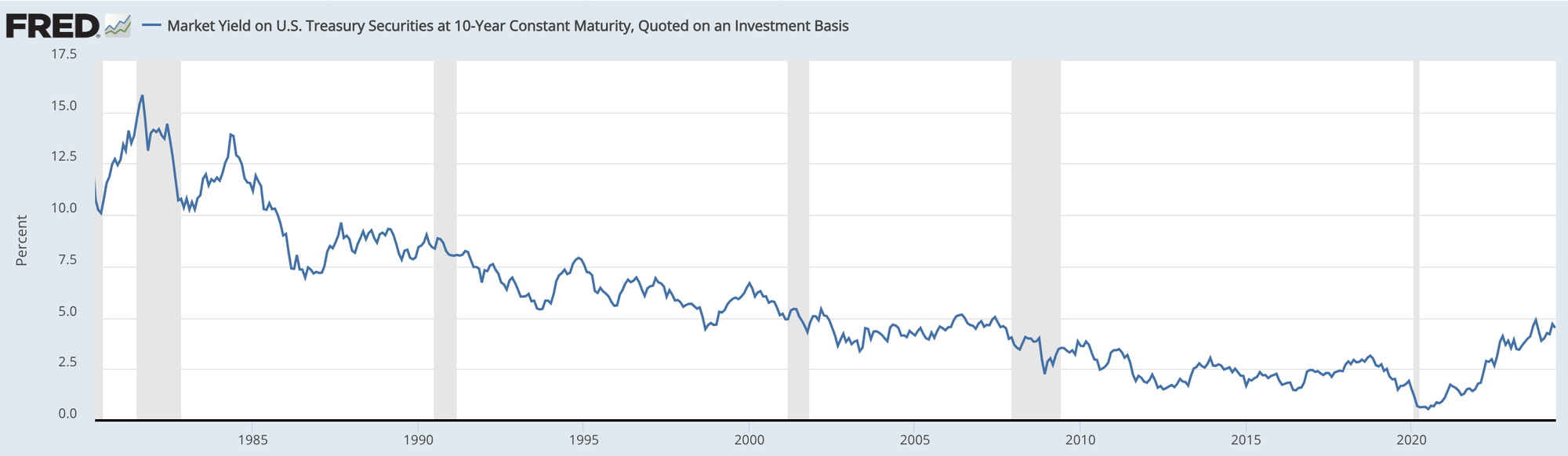

From a longer term perspective, there's also reason to be bullish. We're at the end of a 42-year bull run that started in 1982 when Treasury bonds paid over 15%--and steadily declined from there. We hit an all-time low of just 0.65% yield in 2020 and have been climbing since then:

I think we get one big retest to mark the true end of the downtrend in rates. V-shaped bottoms are rare. Trend changes usually require some volatility, and retest of the lows in yields would "make sense" if something big breaks in the economy due to the fastest-ever raising in Federal Funds Rate ever.

All of this to me says "blow off top" in equities, real estate and other paper assets. (Wait isn't real estate a "hard" or "real" asset? It was, but isn't right now--that's another post for another time.)

After the Peak

Once we see the peak--likely to occur sometime this summer or near the election--I think the wheels fall off. While the markets and headlines are focused on plentiful liquidity, under the hood, macro data seems to be breaking down.

Jobs

One of the most troubling data points is the non-farm payroll data. The headlines have said that we've gained something like 600k jobs over the past year--but the data is based on a lot of statistical assumptions and subject to revisions for a long time. The worst assumptions are:

- Birth / death model - which assumes numbers for businesses started and ended (and the resulting employment changes) from surveys with low response rates

- Seasonal adjustments - statistical forecasts for what the reported data means on an annual basis, which all broke down with massive Covid disruptions

After revisions, it looks like we're seeing a massive swing in reported numbers, from gaining +600k jobs to losing -200k! On top of that the government models show a massive gain in part-time jobs while full-time jobs have declined. Not good.

Worse, it looks like California makes up over 20% of recent job losses (vs only 11% of the country's population). As in most things, California tends to lead the pack...

Unemployment

Unemployment numbers also look to be skewed. The main reason for this is that most states haven't updated their unemployment benefits to keep up with inflation. California hasn't updated their benefits in 20 years!

During that time, the minimum wage went from $7.75 / hour to $20 / hour–but unemployment still only pays the same $450 / week up to $11,000 total. It's not hard to see how people might be choosing to take part time jobs or drive an Uber instead of applying for unemployment.

Corporate Summary

Each one of these bullet points could be multiple blog posts, so here's a quick summary of what I'm seeing:

- Bankruptcies are running at a faster pace than last year, and both this year and last year were the fastest rates since 2009

- Commercial real estate is in a slow-motion implosion, with most companies trying to prevent transactions. The ones that can't give the keys back to their bank, and when it does sell, the haircut is as much as 90% off of prices paid as recently as 2021

- This represents a double-whammy in that the those companies lose money, and then the bank that made the loan loses money

- The layoff announcements keep coming

Consumer

The picture isn't better for consumers:

- Florida, Texas and Arizona real estate markets continue to slide

- AirBNBs are being dumped in places like Coral Gables at a crazy rate

- Mortgage delinquencies are picking up

- Gasoline demand is soft for this time of year (less driving generally means a weaker economy)

- Delinquencies and charge-offs on credit card balances are also high and gaining steam

Summary

Overall, I think we're in the middle of a "Summer of Denial" with everyone hoping things will turn out okay--and a flood of money punishing anyone who dares to place bearish bets too early. The reality on the ground will continue to degrade--making the coming resolution worse when it comes.

I think the most likely timing is right after the election. Until that's over, Biden's administration is incentivized to keep the impossible flywheel spinning. Once election day has passed though, you might have the inevitable happen as fast as possible and give yourself as much time as possible to clean it up before the next round of elections.

One of the worst elections outcomes may be Biden winning while the Republicans re-take the Senate. When cracks start to show, a Republican Senate would likely put their political agenda ahead of any "minor" concerns, like the wheels falling off the economic bus.