What is Money?

Misunderstanding money is one of the primary causes of bad decision making, economic confusion, and general mayhem that I see in the world today. It's really hard to make navigate our world, which is SO dominated by economics, if you can't even get a clean grasp of the core element: money.

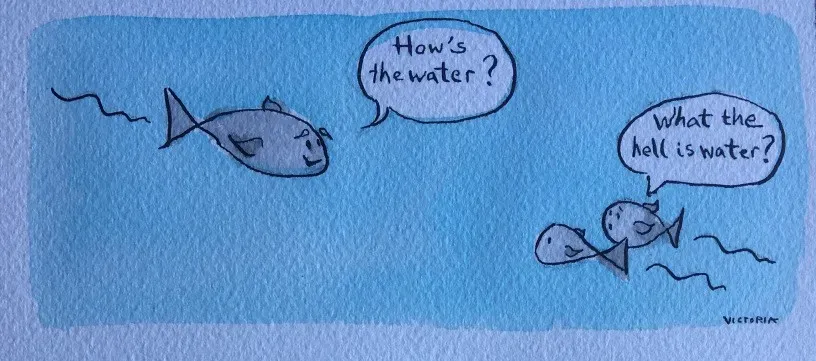

It's very much like we're fish, trying to understand the world, but having no concept of water, even though its the defining element of our lives.

Most definitions I've seen are poor, incomplete, or just kind of too fuzzy to be useful. Let's build one up from first principals.

Barter? No. Debt!

Maybe you've heard the story that before money, trade was done through barter. I had fish, you had wine, and we traded. But that never really happened at scale--it's just too hard for people to match up wants and needs immediately.

Instead, at the center of all trade is debt. If I have a fish today (which probably won't be much good in a day or two...) and you're a hungry wine-maker today, you may not have anything to give me today. But we both know that you'll be flush with wine in a few weeks, when the latest batch is done. So I give you the fish today, and you'll owe me a flask of wine when it's ready. We've created debt!

Since people used to only live in small bands of 150 people or less, we could pretty much just keep track of all the debts we owed and owed to us in our heads. The only person who owes me is the wine-maker (and maybe his family). It's a system of 1:1 personalized debt, and since there aren't that many nodes in our small world, it works just fine.

But what happens when we start trading in wider circles or across larger geographies, where maybe we don't see the same people that often? Tracking 1:1 debts stops working pretty fast. There's too many possible combinations of debtor/creditor, and it's too easy for a shady debtor to just disappear.

Enter money.

Defining Money

Money is way to shift the scope of the debt from the individual to the group.

"Money" is actually two separate things:

- Currency

- A fiction of "money-ness"

The currency is what is actually transferred when somebody pays you: fancy paper, gold, silver, shells, beads, cigarettes, or even just a balance in a bank ledger somewhere.

The fiction of "money-ness" is a shared social belief that there are a group of people who value the currency enough to give you something in exchange for it. The fiction can be shared by one very small group or multiple very large groups. The groups can shift and change--people might value cigarettes during wartime and not so much outside of it.

At it's core though, the fiction of money-ness imbues the currency with its value because you'll have the ability to trade it for something else: food, water, shelter, entertainment.

When someone settles a debt by "paying you", what they're really doing is giving you a promise that somebody else (who belongs to the group of people who value that currency) will–at a time and place of your choosing--give you something you value. You earned that right by giving someone in the group something of value today.

Think about it--you don't value fancy green paper or gold or shells or beads directly. You value them because they represent your ability to get fed, pay rent, buy clothes and cars, etc. But those things aren't provided by the person who gave you the paper, gold, etc. They're provided by other people who also value the paper.

The currency you posses is actually a debt owed to you--not by any single person or company. It is "owed to you" in a general way by the group. The currency represents a collective promise by the group to make good on the value you provided to a specific member of the group in the past.

By shifting the debt from the individual to the group, money makes trading much easier. You no longer have to match wants between the two parties. Each transaction ends when money changes hands, so there's no complex and growing web of interconnected debts. You can also trade with strangers without worrying about how to chase them down to collect a debt.

This post was a bit academic, but now that we have a good definition of money, we can rely on it when discussing what's going on in our economy going forward.